[vc_row][vc_column width=”1/1″][mk_custom_box bg_color=”#466f73″ bg_position=”left top” bg_repeat=”repeat” bg_stretch=”false” border_color=”#fff” padding_vertical=”30″ padding_horizental=”20″ margin_bottom=”10″ min_height=”100″]

Do you need help? Start with part one of the series here: Three Signs That It’s Time to Get Some Help

If you’ve decided you need help, probably one of your next questions is: Can I really afford to get help?

What you can and can’t afford depends on two factors: what your priorities are, and what value you will get from spending the money. I may have $5,000 in the bank and still feel I can’t afford a $500 couch because there are other, more important things to save my money for. Then again, I may have $250 in the bank and feel just fine about spending $200 on groceries because, well, my family has to eat!

Value is the importance, worth, and usefulness of something, and you must consider more than a simply hourly or monthly price to determine value. There is a reason small business owners choose to use expensive software rather than free alternatives, and it all comes down to value. Can you create all of your own invoices in Open Office, send them manually by email, and record your payments in a spreadsheet? Absolutely, you can.

Yet many businesses choose, instead, to pay for software like Quickbooks. What does Quickbooks give you? Your clients get invoiced either way, right? Yes, but with Quickbooks, the invoices are auto-generated based on the values you enter. With Quickbooks, you get a professional appearance. With Quickbooks, your accounting system is automatically updated.

Whenever you spend money on your business, whether it’s for software, marketing, office space, or assistance, you’re doing it because it adds value.

Three Ways to Measure the Value of a Virtual Assistant

1. A Virtual Assistant saves you money

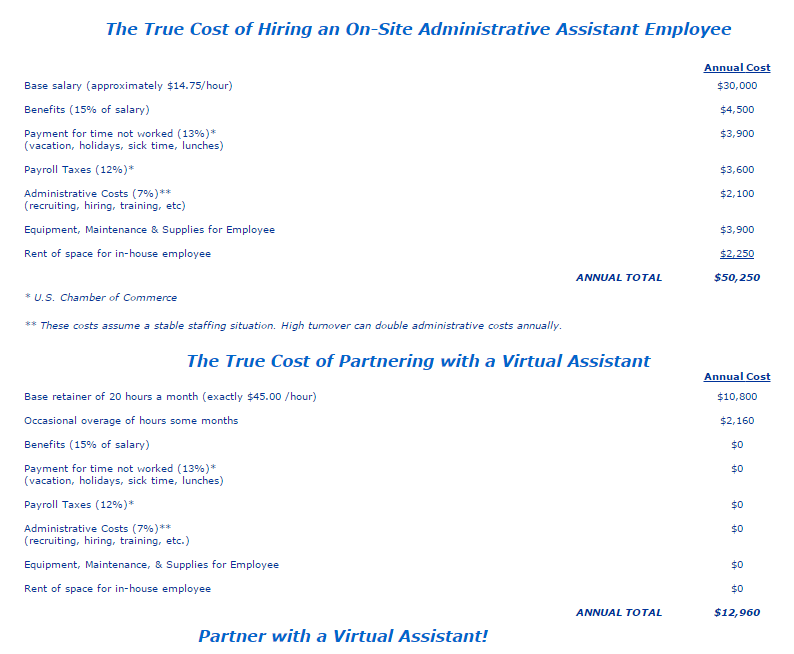

How does the cost of a Virtual Assistant compare to the cost of an in-house assistant? Here is a great comparison from virtualexecservices.com:

Screenshot from Virtual Executive Services

As you can see, an in-house assistant has a lot more associated costs than you might think! If it sounds more attractive to pay (in this example) $14.75 per hour instead of $45 per hour, remember that you also have to account for benefits, sick time, lunch breaks, payroll taxes, administrative and equipment costs, and office space! With a Virtual Assistant, you pay for the work done, period. The Virtual Assistant covers her own equipment and office space, her own taxes, her own insurance, and everything else. She is already a skilled professional, so there is no training involved, either. In the end, you’re looking at saving about $37,000 annually if you partner with a Virtual Assistant!

2. A Virtual Assistant makes you look good

An awesome Virtual Assistant is a huge asset to your business when it comes to appearances:

- Status:

No longer does the CEO schedule all of her own appointments and meetings. Now, her scheduling is handled by a professional third party.

- Organization:

Never again does the business owner need to miss a deadline, email, or invoice. His customers will feel respected when every email is attended to, deadline is met, and invoice is paid in a timely manner.

- Marketing:

Haphazard social media efforts should be a thing of the past as your VA helps make sure the editorial calendar is updated and the right content is scheduled on the right networks at the right time.

Good partnerships make you look good!

3. A Virtual Assistant saves you time

To those curious how much time can be saved, I’d remind you that your Virtual Assistant specializes in the type of work that she does. Therefore, I usually estimate that a great VA can complete most tasks in about 25-50% less time than it would take the client to do the same work. Essentially, this means that for every hour you gain, you’re only paying for about 45 minutes of work (if you’re paying hourly).

If your Virtual Assistant supports you for 20 hours per month, she is likely saving you about about 24-30 hours. That’s 30 hours per month that you are suddenly free. If your VA is saving you what amounts to three days of work, what is that worth? Could you take off early a couple days a week and spend more time with your kid? Could you take on another client project (billable work)? Could you launch a side business, explore a hobby, further your education?

Let’s look at it another way. How much is your time worth? $50 per hour? $100 per hour? More? If your billable rate in your line of work is $100 per hour, you’ve just put $3k back in your pocket, potentially. If you have a family that misses you, the extra time may be literally invaluable.

Next week, we’ll wrap up by going over best practices for working with a Virtual Assistant.

[/mk_custom_box][/vc_column][/vc_row]

Leave A Comment